Bloomberg.com

In just one week Bridgewater, the world’s biggest hedge fund firm, more than quadrupled how much it’s betting against European Union companies. Bridgewater manages about $150 billion in global investments for approximately 350 of the largest and most sophisticated institutional clients.

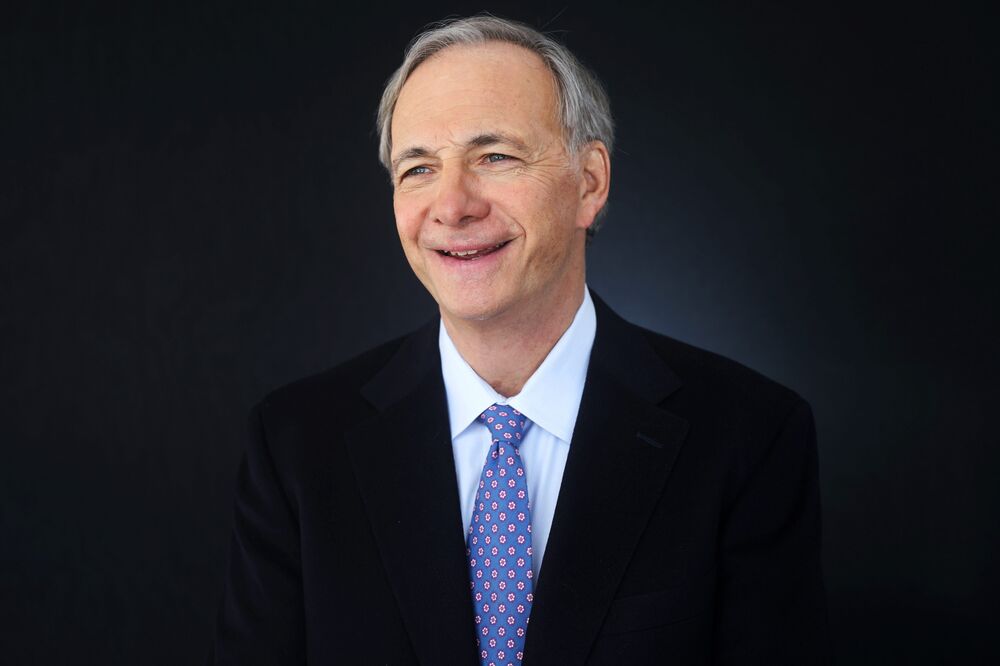

The firm, run by Ray Dalio, has at least $13.1 billion in shorts, or wagers that a stock will fall, according to EU regulatory filings. That’s up from the $3.2 billion it had disclosed on Feb. 1. It also more than doubled the number stocks it’s shorting to 44 from 20.