VIX Squared @vixsquared

What is SKEWSM?

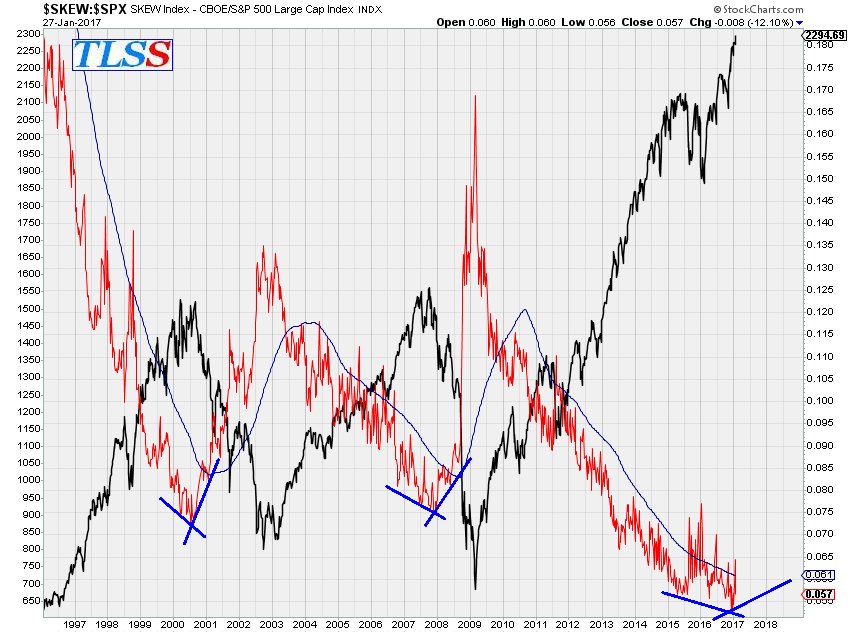

The CBOE Skew IndexSM - referred to as "SKEW" – is an option-based indicator that measures the perceived tail risk of the distribution of S&P 500® log returns at a 30- day horizon. Tail risk is the risk associated with an increase in the probability of outlier returns, returns two or more standard deviations below the mean. Think stock market crash, or black swan. This probability is negligible for a normal distribution, but can be significant for distributions which are skewed and have fat tails. As illustrated in the chart below, the distribution of S&P 500 log returns has a sizeable left tail. This makes it riskier than a normal distribution with the same mean and the same volatility. SKEW quantifies the additional risk.